33+ Genworth self employed calculator

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. This percentage is a combination of Social Security and Medicare tax.

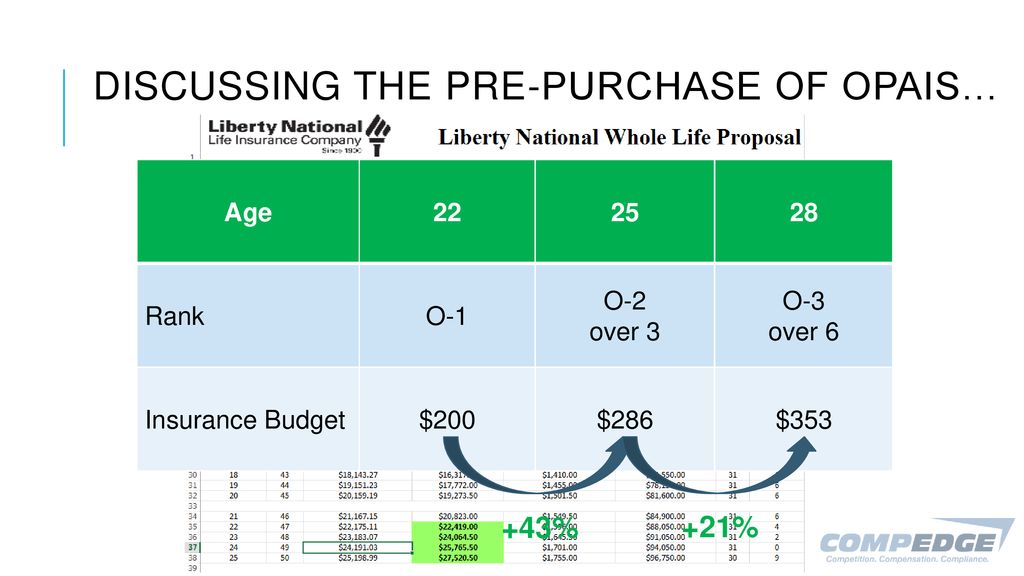

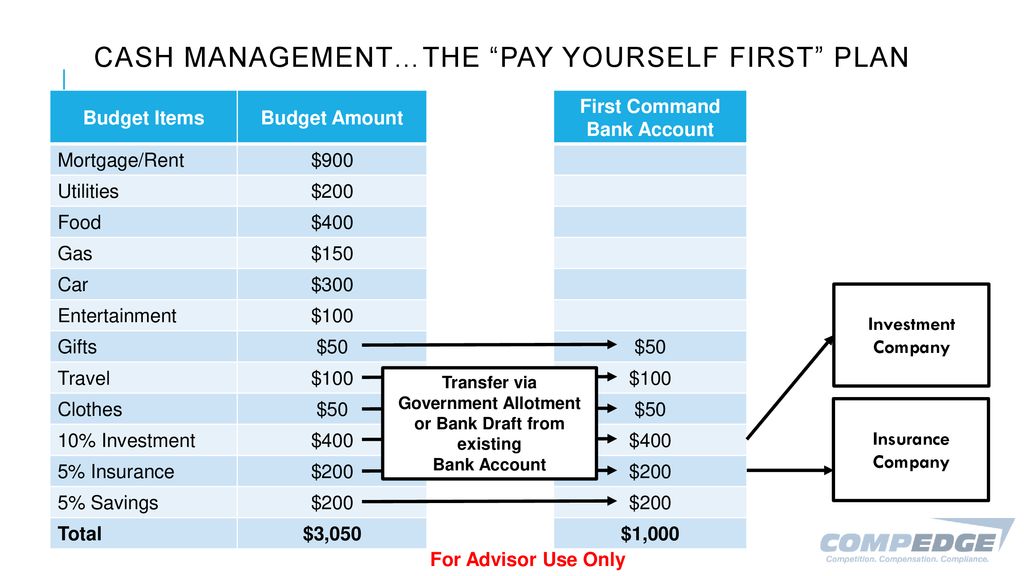

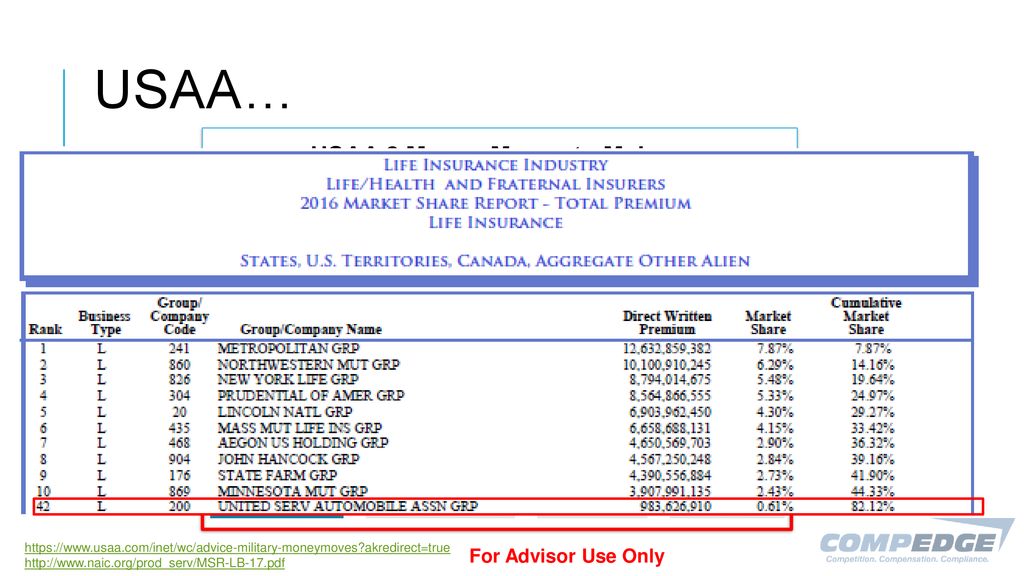

Life In The Military Bryan Mueller Devin Reid Ppt Download

Selfemployed borrowers business only to support its determination of the stability or continuance of the borrowers income.

. Firstly you need to enter the annual salary that you receive from your. Total annual gross income all applicants 10000000. This is your current estimated cost of long term care.

We can quickly assess your income and work out if you. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves.

The calculator uses tax. According to the Genworth Financial 2010 Cost of Care Survey the estimated average cost for a nursing home stay was 67525 per year. Self Employment Tax Calculator.

Self-employed workers are taxed at 153 of the net profit. Our servicing estimator provides an indication as to whether a borrower may be able to meet their loan repayments. Find a Dedicated Financial Advisor Now.

Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate income quickly and easily. Unique self-employed income calculator to help work out what you need to pay towards your income tax National Insurance take home pay. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Genworth self employment income calculator. Redirecting to self-employed-mortgage 308. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA.

Use this Self-Employment Tax Calculator to estimate your. We aim to make. 1 W-2 Income from Self-Employment Only add back the eligible Other deductions such as Amortization or Casualty Loss.

Your employment wages and tips should have a 62 deduction. Available in TurboTax Self-Employed and TurboTax Live Self-Employed. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

2 Schedule B Interest and Ordinary Dividends a. To estimate and analyze a borrowers cash flow situation enter the required data into the cash flow analysis calculator according to the calculations that appear on the borrowers tax returns. A typical profit and loss statement has a format similar.

Employees who receive a W-2 only pay half of the total. However our mortgage brokers are experts in lending to self employed borrowers trusts companies and professional investors. This product feature is only available after you finish and file in a self-employed.

If you are self employed use this simplified Self Employed Tax Calculator to work out your tax and National Insurance liability. Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their. Determining a self-employed borrowers income isnt always straightforward.

The calculator needs some information from you before working out your tax and National Insurance. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Do Your Investments Align with Your Goals.

Life In The Military Bryan Mueller Devin Reid Ppt Download

Life In The Military Bryan Mueller Devin Reid Ppt Download

Life In The Military Bryan Mueller Devin Reid Ppt Download

Life In The Military Bryan Mueller Devin Reid Ppt Download

Life In The Military Bryan Mueller Devin Reid Ppt Download

Life In The Military Bryan Mueller Devin Reid Ppt Download